Live Oak Banking Company decided on August 25, 2022, the Florida Supreme Court, in answering the question certified to it by the United States Court of Appeals for the Eleventh Circuit held that “because Florida's filing office, the Florida Secured Transaction Registry, does not employ a ‘standard search logic', the safe harbor cannot apply, which means that a financing statement that fails to correctly name the debtor as required by Florida law is “seriously misleading” and therefore ineffective.” In the recent Florida Supreme Court case of 1944 Beach Boulevard, LLC, Appellant, V. That section provides that the safe harbor applies when a financing statement that fails to correctly name the debtor is disclosed by “a search of the records of the filing office under the debtor's correct name, using the filing office's standard search logic, if any.” Section 679.5061 of the Florida Statutes, similar to a provision in the UCC in other states, provides a safe harbor for slightly inaccurate names of debtors on financing statements.

In most states, the search engine logic utilized by the State’s Secretary of State or similar agency that accepts the recording of the financing statements and provides a public index allows one searching the index to be able to locate a financing statement where the debtor’s name is not precisely and exactly stated, but is reasonably close to being accurate. Unlike with a real estate mortgage, the terms of the security agreement control with respect to the lien created by the transaction, and the filing of the financing statement is necessary in order to place all other prospective creditors and interested parties on notice of the existence of the security interest. The security interest is perfected when the last of the three items occur.

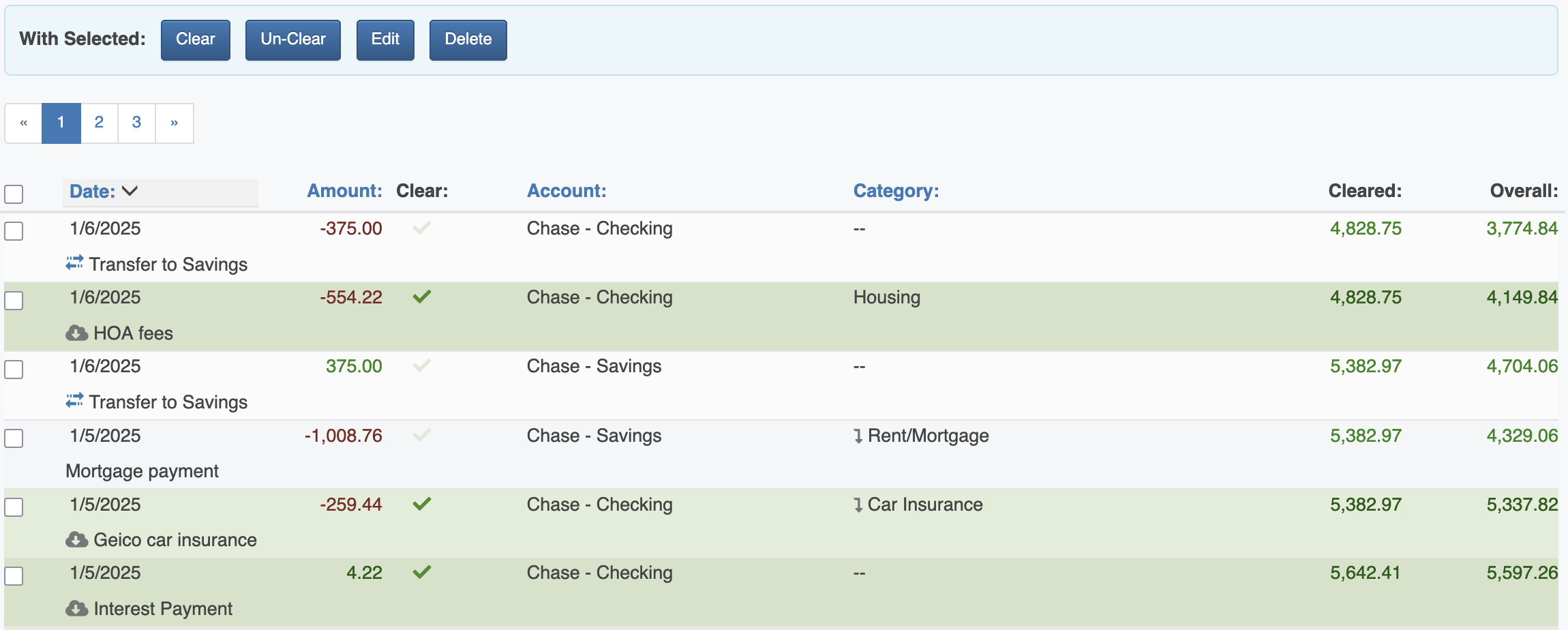

#Florida secured transaction registry search code#

Under the Uniform Commercial Code (UCC), which is contained in Chapters 671 through 679 of the Florida Statutes, three actions need to occur in order for a security interest to be perfected – (1) an agreement in writing creating the security interest (the security agreement), (2) consideration passing between the parties, and (3) in most situations, the filing of a financing statement (UCC-1 form) with the Florida Secured Transactions Registry. Since the mid-1960s, lenders, and vendors in Florida have been able to perfect security interests in personal property collateral in order to help insure repayment of debt. SECURED LENDERS AND SECURED VENDORS BEWARE

0 kommentar(er)

0 kommentar(er)